If you purchase a fully electric company car in 2025 and you drive more than 500 kilometers privately per year, you can still take advantage of the reduced private use addition (bijtelling) in the next five years to come.

Higher private use addition rate starting 2026:

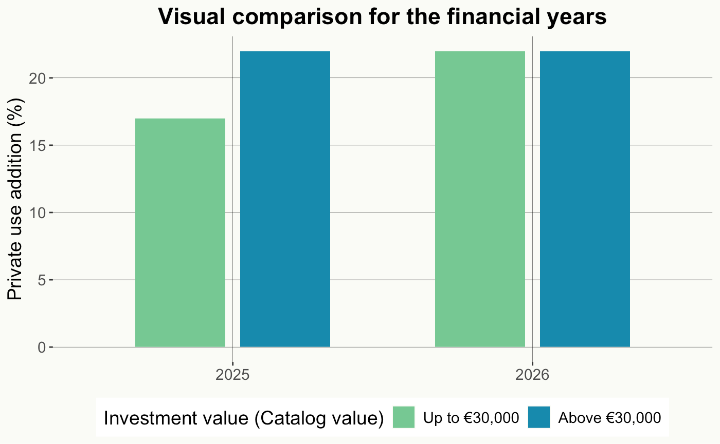

If you are considering purchasing a fully electric company car, keep in mind that for vehicles with a first registration date on or after january 1, 2026, an additional rate of 22% applies. Note: from that date, fully electric cars no longer have any addition advantage compared to cars with co2 emissions.

Lower private use addition rate until the end of 2025:

The amount of the private addition rate (until the end of 2025) depends on the co2 emissions and the first registration date of the car. For fully electric cars with a first registration date in 2025, a reduced addition rate of 17% applies on the first €30,000 of the list price. On the amount above €30,000, the rate is 22%. The addition is calculated on the list price including vat and bpm and accessories installed by or on behalf of the manufacturer or importer before the first part of the license plate is issued.

The reduced addition rate applies for a period of 60 months. This period starts on the first day of the month following the month in which the car was first registered. Once the 60 months have passed, the addition rate will be reassessed according to the rules applicable at that time. The first registration date for new cars is the same as the date the license plate is issued in the Netherlands, or for imported cars, the date the car was first registered abroad.

Example:

If you purchase a fully electric company car with a catalog value of €30,000 in 2025, the private use addition rate is 17%. This results in an annual taxable amount of €5,100 for the next five years.However, if you buy the same car in 2026, the rate increases to 22%. This will result in an annual taxable amount of €6,600.

That means registering your car before 2026 can save you around €1,500 in taxable income every year. This advantage is €7,500 over the next five years.

Conclusion:

By registering a company electric car before the end of 2025, you will benefit for the next five years of annual tax advantages. Starting in 2026, this incentive will be completely phased out. So timing of the purchase is relevant to benefit lower taxation.