When inheriting real estate, heirs are required to pay inheritance tax. In a case before the Court of Appeal of ’s-Hertogenbosch in the Netherlands, the heirs argued that they had paid € 30,000 too much in inheritance tax on an inherited property.

What was the issue?

- WOZ valuation of an inherited property

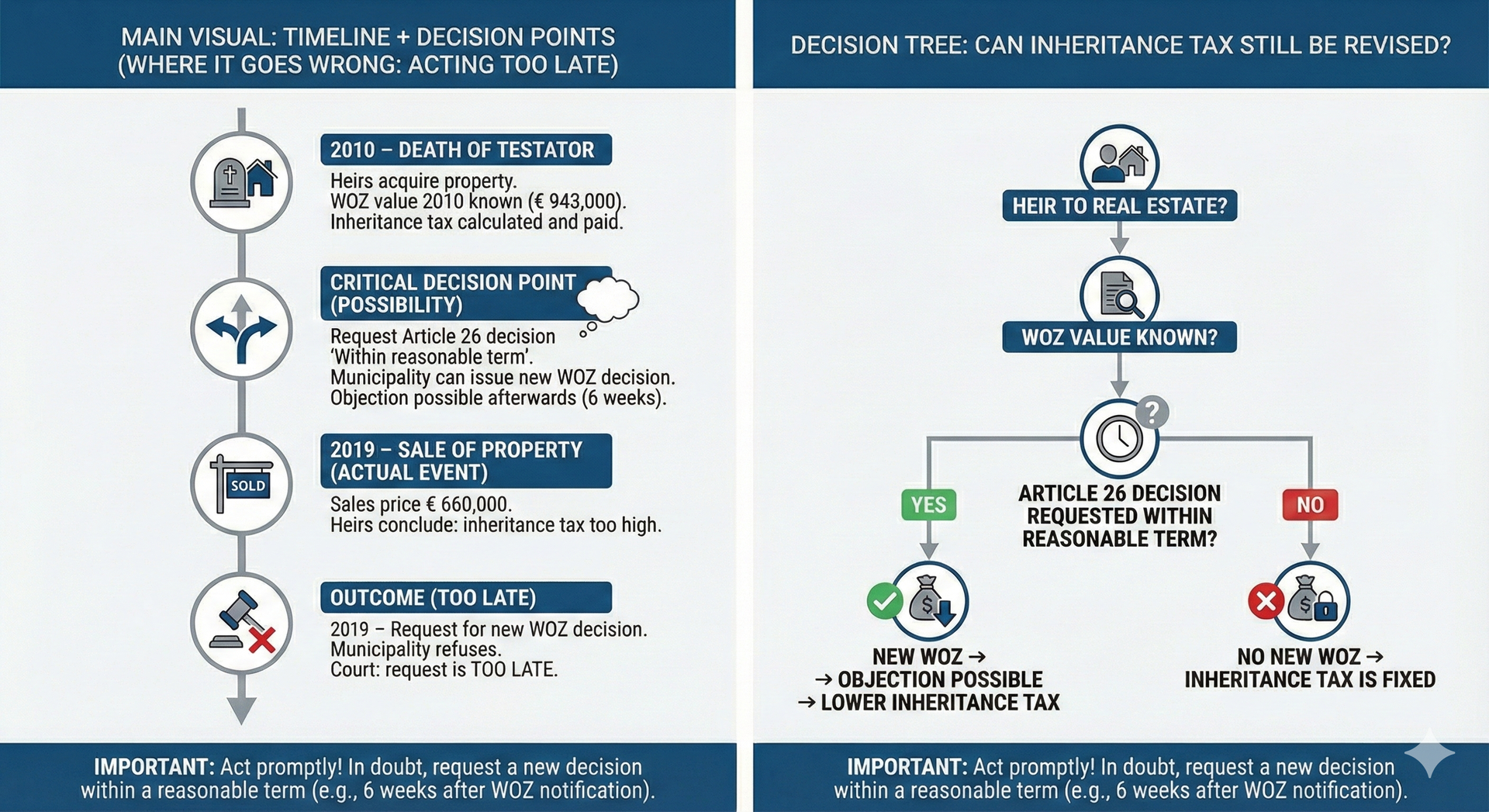

In 2010, the deceased passed away. The heirs were required to pay inheritance tax, among other things, on the property they inherited. The tax base was a WOZ value for the 2010 tax year of € 943,000. - Sale price turns out to be significantly lower than the WOZ value

Nine years later, the property was sold for a much lower amount. On 1 October 2019, the property was sold for € 660,000. Based on this lower sale price, the heirs took the position that they had paid € 30,000 too much in inheritance tax nine years earlier. - Is it possible to issue a new WOZ assessment?

The executor contacted the Dutch Tax Authorities, who indicated that a refund of inheritance tax would only be possible if a new WOZ assessment for the 2010 tax year were issued with a lower WOZ value. The heirs would therefore have to request a so-called “Article 26 decision” from the municipality and subsequently challenge the WOZ value through an objection procedure. However, the municipality refused to issue an Article 26 decision.

What does the court say?

- There is no statutory deadline

In the past, municipalities determined a WOZ value that applied to multiple tax years. Until 2004, a deadline therefore existed within which an Article 26 decision could be requested. Because municipalities now determine the WOZ value separately for each tax year, this deadline was abolished as of 2005. - A reasonable period must apply

This does not mean, however, that heirs may request a new WOZ assessment at any point in time. Allowing this would lead to practical and administrative problems for municipalities. In short, a new interested party must request a new WOZ assessment within a reasonable period, according to the Court of Appeal of ’s-Hertogenbosch. - A request made nine years later falls outside a reasonable period

The deceased had already passed away in 2010, and the heirs could have requested a new WOZ assessment in that same year. The executor only requested a new WOZ assessment in 2019. This falls outside a reasonable period, according to the court. The fact that the settlement of the estate took a long time does not change this and is at the risk of the heirs.

Conclusion

If you are an heir, you should request a new WOZ assessment within a reasonable period. If necessary, you can then file an objection against this assessment within six weeks. If the WOZ value is reduced, you will pay less inheritance tax. The court did not specify what period should be considered reasonable.

Tip; Try to request an Article 26 decision within six weeks after the WOZ value has been made known to you. This period originates from the time when the WOZ value applied to multiple tax years. If this deadline is not met, the municipality will have to assess whether your request was submitted within a reasonable period.