When selling a business asset, your company must pay corporate income tax (hereinafter: “CIT”) on the book profit. You can defer this by forming a reinvestment reserve (hereinafter: “RIR”). This sounds attractive because it allows you to keep more liquidity within the company. However, this is not always beneficial, especially in times of increasing profits or higher CIT rates. In this article, we explain how it works and in which situations it is better to form or not to form an RIR.

Reinvestment reserve and deferred taxation – how does it work

If you immediately settle the book profit, your company will normally pay between 19% and 25.8% CIT if you settle a book profit. Under certain conditions, you can defer this taxation by transferring the book profit to an RIR. If you subsequently invest in a new business asset, you may deduct the RIR from that investment.

As a result, you do not have to pay tax on the book profit immediately. You only pay tax later, because in the following years you can depreciate less on the new asset. This provides an interest and liquidity advantage. In other words, in the short term, you keep more cash inside the company.

"

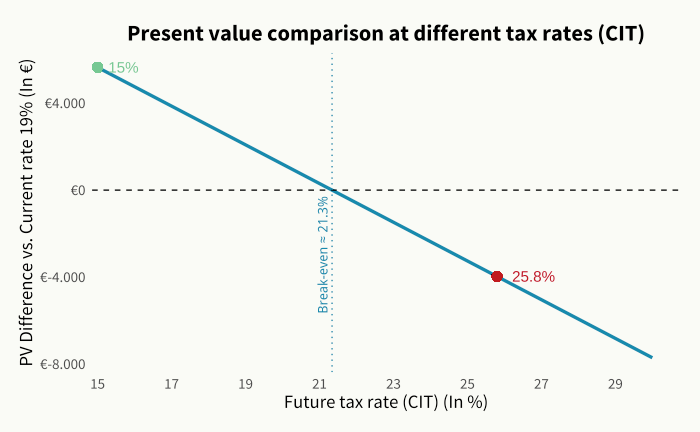

Explanation of the graph

Without RIR, the company pays €19.000 tax immediately in 2025. With RIR, the payment is deferred, and over the years 2026–2030, a total of €16.916 is paid (assuming a discount rate of 4%). In total, the company pays slightly less tax and also pays it later in time. The liquidity and interest advantage can be interesting.

By postponing tax, the company keeps more liquidity in the short term and gains a cash-flow benefit. Instead of paying €19,000 at once, the total present value of tax payments is lower when deferred through RIR.

In other words RIR doesn’t eliminate tax; it shifts it to the future at a lower effective cost. This creates a liquidity advantage and stronger cash position for the company.

Practical example for different scenarios

We use the same assumptions as in the previous example:

- Book profit: €100,000

- Current rate: 19%

- Reinvestment over 5 years (each year €20,000 less depreciation)

- Discount rate (interest effect): 4%

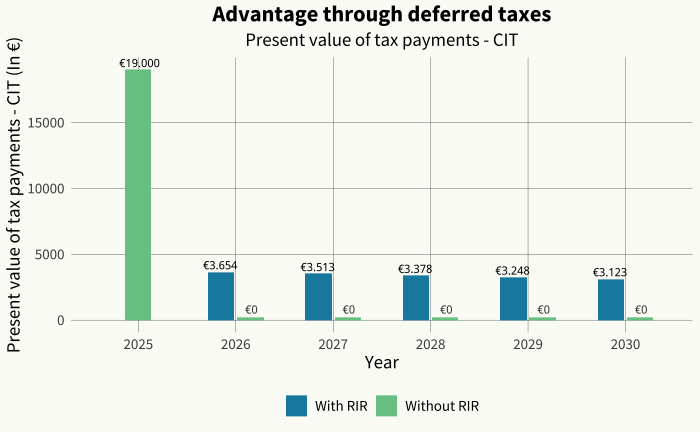

We examine how the present value of the tax payment changes when the current CIT rate of 19% is compared with two extreme situations: a lower rate of 15% and a higher rate of 25.8%.

Explanation of the graph

This graph compares the present value of tax payments under different future CIT rates. It highlights a break-even point at approximately 21.3% — below this rate, using RIR creates a financial advantage (positive PV difference). Above this rate, deferring tax becomes less favourable, and at 25.8% the RIR would result in a negative tax impact compared to paying tax now.

Key takeaway:

- RIR is beneficial only when the future tax rate stays below the break-even level.

- If CIT increases above ~21.3%, the deferred payment could cost more than paying tax immediately.

Scenario | Future CIT Rate | PV of tax payment | Difference versus direct payment | Subconclusion |

Lower tax rate | 15,0% | €13.355 | €5.645 +/+ | Favourable |

Higher tax rate | 25,8% | €22.970 | €3.970 -/- | Unfavourable |

Break-even rate | 21,3% | - | - | No difference |

Main conditions for applying the RIR

- Intention to reinvest – There must be a genuine intention to reinvest.

- Investment period – The reinvestment must take place within 3 years.

- Depreciation period – The replacement investment must last longer than 10 years.

(Reference: Reinvestment Reserve | Dutch Tax Authorities)

Conclusion:

Forming a Reinvestment reserve is not mandatory, but it is a (strategic) option for the company to consider. With stable and/or decreasing CIT rates, the deferral of taxation offers an advantage. With increasing profits or increasing future CIT rates, deferred taxation is a disadvantage.