By some, the construction of tiny houses is seen as a solution to the housing shortage. But how is a tiny house classified for tax purposes? The Dutch Tax Authority’s Knowledge Group on Income Tax provided further clarification on this matter.

Tax explanation and benefits

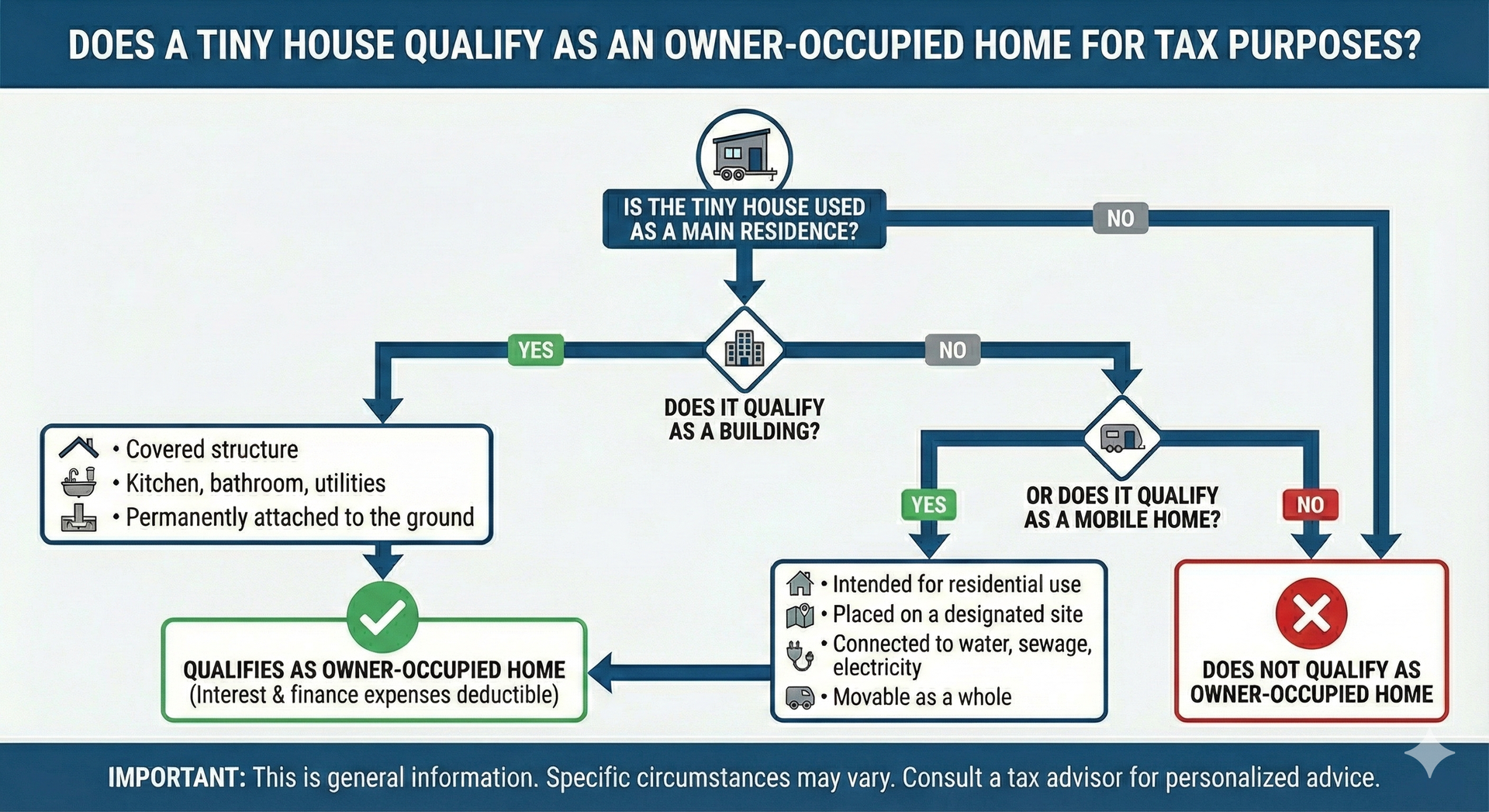

From a tax perspective, a property qualifies as an owner-occupied home if you are the owner of a building, a ship permanently attached to a location, or a mobile home (or part thereof) that is used as your main residence.

Owning an owner-occupied home provides certain tax benefits. For example, mortgage interest and financing costs incurred for the acquisition of the owner-occupied home are deductible from taxable income. Please note that a small percentage of the value of the home must be added to your income. This is referred to as the Imputed rental value (owner-occupied home) (In Dutch: de eigenwoningforfait).

Due to these tax benefits, it is important to determine whether a tiny house qualifies as an owner-occupied home for tax purposes. First, it must be assessed whether a tiny house falls within the definition of a building or a mobile home permanently attached to a location.

Discussion - qualification as a building

Dutch tax legislation does not provide a definition of the term “building.” However, other legislation indicates that a building is a structure that forms a covered, enclosed space accessible to people. In addition, the building must contain all essential features of a residential unit, such as a kitchen, a bathroom, and utility installations. Finally, the building must be permanently attached to the ground, for example by being placed on a foundation. It is irrelevant that the building may technically be movable.

Sub conclusion - Based on these criteria, the Knowledge Group concluded that the tiny house qualifies as a residential unit. It is a building that contains all essential residential features and is placed on a foundation of concrete slabs intended to remain permanently in place.

Discussion - qualification as a mobile home

A tiny house qualifies as a mobile home if the structure is intended for residential use and is placed on a designated site that can be moved in whole or in part. In this case as well, the mobile home must be permanently attached to the ground. Relevant criteria include the degree of mobility and the presence of fixed utility connections, such as electricity and sewage.

Sub conclusion - According to the Knowledge Group, the tiny house is placed on a site with utility connections and can be moved as a whole. Because the tiny house is attached to the ground by means of a concrete slab foundation and is connected to water, sewage, and electricity, it qualifies as a residential unit.

Visual summary of the regulation

Conclusion

According to the Knowledge Group, a tiny house qualifies as either a building or a mobile home and therefore qualifies as an owner-occupied home for income tax purposes. As a result, mortgage interest and financing costs incurred for the acquisition of the owner-occupied home are deductible from Box 1 income.

Based on the published position of the Knowledge Group and the criteria applied, greater clarity now exists regarding the question of whether a tiny house qualifies as an owner-occupied home for income tax purposes. Please note that in each individual situation, the relevant facts and circumstances must be assessed to determine whether the specific tiny house qualifies as a residential unit.